2022.03.02

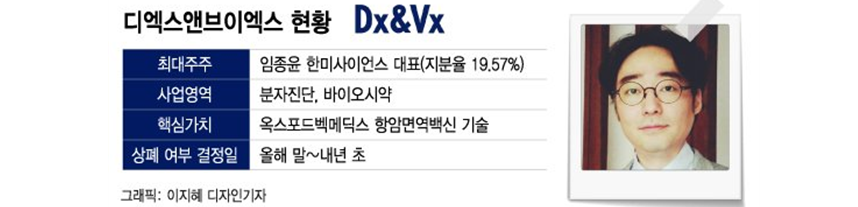

Chong-Yoon Lim, CEO of Hanmi Science, will begin rebuilding Dx&Vx, where he became the largest shareholder this year. Dx&Vx is a company that is about to be delisted, but it has the technology to develop vaccines for cancer immunotherapy, which has emerged as a next-generation biotechnology. He plans to normalize the company with his know-how related to personalized treatment and businesses tailored to infants and pregnant women and ultimately develop it into a core company of Hanmi Pharmaceutical Group.

According to the pharmaceutical and bio industry officials, Lim sold 450,000 shares of Hanmi Science, the holding company of Hanmi Pharmaceutical Group, after regular market hours, through which he secured about KRW 20 billion in cash.

This is the first sale made by CEO Lim since he inherited 3,545,066 shares from his late father, Sung-ki Lim, who was the founder and chairman of Hanmi Pharmaceutical Group. The eldest son of the late founder Lim reportedly sold some of his shares to pay inheritance tax. He had taken out stock-backed loans, but it appears that it was not enough to pay the inheritance tax in full. As a result of the recent sale of his shares, CEO Lim’s stake in Hanmi Science dropped from 8.94% to 7.88%.

It is said that the sale also has something to do with Dx&Vx in considering the big picture. CEO Lim became the largest shareholder of Dx&Vx by securing a 19.57% stake in the company in October last year when the trading of its stocks was suspended, through an in-kind investment with 277,778 shares of Hanmi Science. CEO Lim was also appointed as an inside director of Dx&Vx in December last year.

An industry insider said, “The decision to invest in Dx&Vx was already made when it was not possible to take out a large stock-backed loan. [...] Ultimately speaking, it seems that [CEO Lim] was willing to reduce his stake in Hanmi Science in order to invest in Dx&Vx.” This shows that CEO Lim regards highly of the value of Dx&Vx.

The value of Dx&Vx mainly comes from Oxford Vacmedix. Dx&Vx is the largest shareholder (43% stake) of the UK company, which has spun off from Oxford University and develops vaccines for cancer immunotherapy and cancer diagnostics techniques. It currently has four anticancer vaccine pipelines and has a patented technology related to recombinant overlapping peptides (ROPs), which are injected into the body to boost the immune system by stimulating the anticancer virus genes. It is said to be a dream technology that enables personalized anticancer immunotherapy. Based on this technology, Oxford Vacmedix received approval to begin a Phase 1 clinical trial on its cancer vaccine, OVM-200, in the UK last year.

The question is whether Dx&Vx will be able to gain momentum in its business operations. Dx&Vx has been suffering losses for nearly six years until the third quarter of last year. This was the reason trading of its stocks has been suspended since 2019. In October 2021, it was recommended to be delisted from the Korea Exchange, and in November, it was granted a one-year improvement period. The improvement deadline falls on November 22 this year, and the company will be required to submit a statement of implementation of the improvement plan and an expert confirmation on the results within 15 days. This means that CEO Lim will need to prove the sustainability of Dx&Vx within the next eight months. The KOSDAQ Market Committee will decide whether to remove Dx&Vx from the stock exchange at the end of this year or early next year.

It appears that CEO Lim will apply his business know-how to rebuilding the company. This was evident in the announcement of new business operations, including “manufacturing, sale, and import/export of baby products and maternity products” and “manufacturing, sale, and import/export of health foods” at an extraordinary general meeting last December. With respect to this, those in the industry speculate that CEO Lim is working to lay a cornerstone for creating synergy with Ofmom, a company that he founded in 2008. Ofmom is running businesses at home and abroad, running postpartum care centers, selling baby formula and strollers, and so on.

Dx&Vx is also expected to work closely with COREE, a big data-based precision medical solution provider established by CEO Lim in 2007. The two companies signed an immune cell profiling research service contract worth about KRW 3 billion last October with the aim of building big data for vaccine development.

The industry forecast is that when the businesses of Dx&Vx mature through the normalization process, it will ultimately create synergy with Hanmi Pharmaceutical Group in nurturing future businesses. An industry official said, “Hanmi Pharmaceutical Group is already developing next-generation vaccines such as messenger RNA (mRNA) vaccines. [...] By working together with Dx&Vx, it will be possible to develop cancer vaccines as a future growth engine.”

Source: Money Today

Chong-Yoon Lim, CEO of Hanmi Science, will begin rebuilding Dx&Vx, where he became the largest shareholder this year. Dx&Vx is a company that is about to be delisted, but it has the technology to develop vaccines for cancer immunotherapy, which has emerged as a next-generation biotechnology. He plans to normalize the company with his know-how related to personalized treatment and businesses tailored to infants and pregnant women and ultimately develop it into a core company of Hanmi Pharmaceutical Group.

According to the pharmaceutical and bio industry officials, Lim sold 450,000 shares of Hanmi Science, the holding company of Hanmi Pharmaceutical Group, after regular market hours, through which he secured about KRW 20 billion in cash.

This is the first sale made by CEO Lim since he inherited 3,545,066 shares from his late father, Sung-ki Lim, who was the founder and chairman of Hanmi Pharmaceutical Group. The eldest son of the late founder Lim reportedly sold some of his shares to pay inheritance tax. He had taken out stock-backed loans, but it appears that it was not enough to pay the inheritance tax in full. As a result of the recent sale of his shares, CEO Lim’s stake in Hanmi Science dropped from 8.94% to 7.88%.

It is said that the sale also has something to do with Dx&Vx in considering the big picture. CEO Lim became the largest shareholder of Dx&Vx by securing a 19.57% stake in the company in October last year when the trading of its stocks was suspended, through an in-kind investment with 277,778 shares of Hanmi Science. CEO Lim was also appointed as an inside director of Dx&Vx in December last year.

An industry insider said, “The decision to invest in Dx&Vx was already made when it was not possible to take out a large stock-backed loan. [...] Ultimately speaking, it seems that [CEO Lim] was willing to reduce his stake in Hanmi Science in order to invest in Dx&Vx.” This shows that CEO Lim regards highly of the value of Dx&Vx.

The value of Dx&Vx mainly comes from Oxford Vacmedix. Dx&Vx is the largest shareholder (43% stake) of the UK company, which has spun off from Oxford University and develops vaccines for cancer immunotherapy and cancer diagnostics techniques. It currently has four anticancer vaccine pipelines and has a patented technology related to recombinant overlapping peptides (ROPs), which are injected into the body to boost the immune system by stimulating the anticancer virus genes. It is said to be a dream technology that enables personalized anticancer immunotherapy. Based on this technology, Oxford Vacmedix received approval to begin a Phase 1 clinical trial on its cancer vaccine, OVM-200, in the UK last year.

The question is whether Dx&Vx will be able to gain momentum in its business operations. Dx&Vx has been suffering losses for nearly six years until the third quarter of last year. This was the reason trading of its stocks has been suspended since 2019. In October 2021, it was recommended to be delisted from the Korea Exchange, and in November, it was granted a one-year improvement period. The improvement deadline falls on November 22 this year, and the company will be required to submit a statement of implementation of the improvement plan and an expert confirmation on the results within 15 days. This means that CEO Lim will need to prove the sustainability of Dx&Vx within the next eight months. The KOSDAQ Market Committee will decide whether to remove Dx&Vx from the stock exchange at the end of this year or early next year.

It appears that CEO Lim will apply his business know-how to rebuilding the company. This was evident in the announcement of new business operations, including “manufacturing, sale, and import/export of baby products and maternity products” and “manufacturing, sale, and import/export of health foods” at an extraordinary general meeting last December. With respect to this, those in the industry speculate that CEO Lim is working to lay a cornerstone for creating synergy with Ofmom, a company that he founded in 2008. Ofmom is running businesses at home and abroad, running postpartum care centers, selling baby formula and strollers, and so on.

Dx&Vx is also expected to work closely with COREE, a big data-based precision medical solution provider established by CEO Lim in 2007. The two companies signed an immune cell profiling research service contract worth about KRW 3 billion last October with the aim of building big data for vaccine development.

The industry forecast is that when the businesses of Dx&Vx mature through the normalization process, it will ultimately create synergy with Hanmi Pharmaceutical Group in nurturing future businesses. An industry official said, “Hanmi Pharmaceutical Group is already developing next-generation vaccines such as messenger RNA (mRNA) vaccines. [...] By working together with Dx&Vx, it will be possible to develop cancer vaccines as a future growth engine.”

Source: Money Today